- Home

- /

- Trending-News

- /

- AfriGO unveils instant...

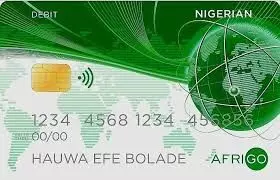

AfriGopay Financial Services Ltd. (AFSL) has unveiled an instant settlement point of sale (PoS)for AfriGO card transactions, a world-first achievement for the Nigerian payment sector.

Supreme News reports that the development underscores the commitment of AfriGO Card to driving advancements in the card payment industry and delivering unparalleled value to all stakeholders.

Mrs. Ebehijie Momoh, the Managing Director and Chief Executive Officer of AFSL, said at a news conference on Tuesday in Lagos that it would provide merchants with immediate cash flow.

Momoh added that it would reduce risks associated with delayed transactions and that it symbolises national pride amidst the country’s rapid electronic payment growth.

Momoh said the implementation of the AfriGO card scheme presents numerous benefits for the industry and the nation by enhancing transaction security, ensuring data sovereignty, and offering better pricing opportunities in local currency.

She added that the scheme reduces interchange fees and alleviates pressure on the naira.

“It indeed symbolises national pride amidst the country’s rapid electronic payment growth,” Momoh said.

According to her, the development underscores the commitment of AfriGO Card to driving advancements in the card payment industry and delivering unparalleled value to all stakeholders.

“This milestone achievement with AfriGO Card, is a testament to our mission to revolutionise the card payment landscape and improve the financial experiences of businesses and consumers across Nigeria and Africa.

“The instant settlement process for real-time PoS transactions is part of our broader strategy to offer value-added services and ensure the payment system in Nigeria retains its leadership role in the African payment space,” she said.

Also speaking, Mr Premier Oiwoh, the Managing Director/ Chief Executive Officer of the Nigeria Inter-Bank Settlement System (NIBSS), said the new service would provide significant benefits to merchants.

Oiwoh added that it would enhance merchants overall experience by offering timely access to funds, improved cash flow and reduced risk of delayed or disputed transactions.

“For cardholders, it ensures a seamless and efficient payment experience with realtime transaction processing and accurate account updates,” he added.

Mr Ugo Obasi, the Chief Operations Officer, AFSL, described the card scheme as an home-grown solution.

Obasi, however, urged Nigerians to be passionate about innovation for economic growth and development.

He said the company would continue to leverage technology and innovation to ensure that AfriGo competes favourably with existing global financial payment systems.

Obasi noted that targeted campaigns were ongoing to train merchants and enlighten the public on the benefits of the card.

“We have a comprehensive strategy that we have put together to ensure that people get to know more about our services.

“We are committed to continuous development and better service offerings.

“There are a lot of partnerships currently that will further help us to drive this adoption and innovation and see how we can extend the services to other African countries,” he said.

He noted that the NIBSS had continued to pioneer industry advancements and would continue in that regard.

NAN reports that the Central Bank of Nigeria, in partnership with the NIBSS in 2023, unveiled the National Domestic Card Scheme (AfriGo) in a bid to expand options for domestic transactions and strengthen the cashless economy.